Securing Safe Harbor for Your Commercial Solar Project

Across the nation, the number of new solar projects for 2019 has increased significantly. In the first quarter of 2019, the US market surpassed two million installations and is on track to double again in the next five years. One reason many more Americans are springing for solar installations than in years past is the expiration of the federal Investment Tax Credit (ITC). The ITC is a tax credit that allows home and business owners to subtract up to 30% of the cost of solar installation from their income taxes. However, this substantial tax benefit for solar owners is scheduled to begin winding down at the end of 2019.

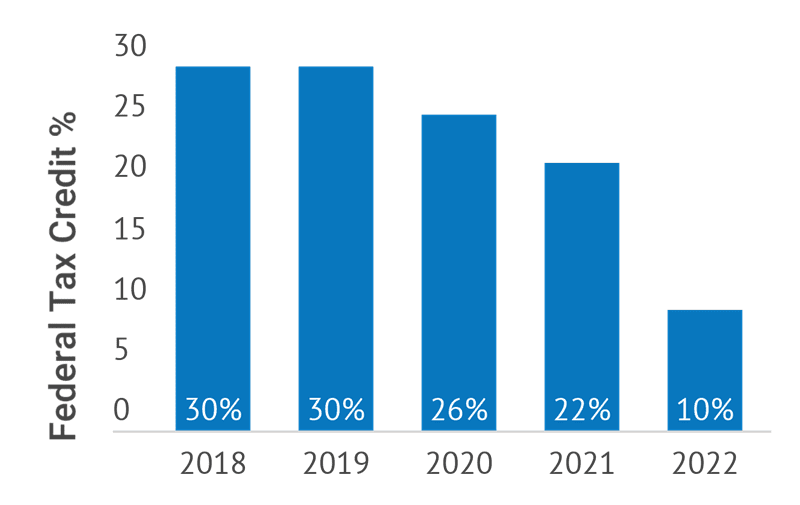

The 30% tax credit for eligible solar system costs will step down over the next three years to zero for residential customers and hold at 10% for utility and commercial projects. 2019 is the final year to claim the full 30% tax credit so savvy homeowners and businesses are choosing to begin solar generation projects now to capitalize on the generous solar incentive and significantly reduce their project payback times.

‘SUNSETTING’ TAX CREDITS

Fortunately, if you haven’t begun your solar project yet, the ITC will not vanish suddenly. The tax credit will “sunset,” meaning it will step down in the percentage of the project’s total cost applied to your tax bill over the next three years. 2020 projects are granted a 26% tax credit, with that number dropping to 22% in 2021, 10% in 2022, and zero for residential solar after that. Commercial and utility solar ITC will hold at 10% indefinitely. This means that if no new legislation is implemented, the ITC will disappear for residential projects in 2023.

Solar installation projects, particularly larger commercial and utility systems, often take more than one year to complete. How then, will the tax credit work for them? More importantly, how can one ensure a project is granted the maximum ITC as it sunsets? Luckily, there is a solution in the form of a new provision granted by the IRS.

SAFE HARBOR FOR INVESTMENT TAX CREDIT

As a general finance term, a “Safe Harbor” is a legal provision to reduce or eliminate legal or regulatory liability in certain situations as long as certain conditions are met. In relation to the ITC and solar installation, Safe Harbor is a way to secure the maximum tax credit even as it is phased out.

The IRS has laid out a provision for commercial and utility solar projects that will coincide with the stepping down of ITC called Safe Harbor. Safe Harbor is a process that ensures the 30% rate established in 2019 can be extended throughout the entire solar installation process.

To receive Safe Harbor status, a project must be completed by 2023. By locking in the 30% rate, commercial and utility solar installation projects stand to save hundreds of thousands in federal tax credits in the coming years. The provision does not apply to only 2019. A project seeking Safe Harbor in 2020 could lock in the 26% ITC, for example.

“It’s an opportunity that’s especially attractive for building owners with a large portfolio of projects looking to plan ahead and secure the 30% tax credits on multiple solar projects in the next five years with minimal risk and upfront cost,” says Maya Resnick, Solar Consultant at IPS. “Say you’re looking at projects for three buildings. You can put down 5-7% on each project (or ~15% of the portfolio) to secure the 30% tax credit on all three projects as long as you finish installation within five years. If for whatever reason, a project doesn’t move forward, you can move those solar modules to another project.”

ROUTE 1 – PHYSICAL WORK

There are two paths to gaining Safe Harbor and the superior tax credit for a commercial or utility solar project. The first approach is to simply begin the construction process in 2019 and complete it before 2023. If the project is not completed by 2023, a project manager must prove that “continuous work” was done on the project, which is potentially very difficult.

The IRS requires “physical work of a significant nature” to qualify, which means that seeking permits, securing funding, design work, and engineering do not count. The physical work can be completed either on-site or off-site but must be on an “integral part of the generating facility,” meaning work done on adjacent buildings or future transmission equipment will not count for Safe Harbor.

Furthermore, work done with equipment in existing inventory does not qualify. This means that working on your “off-the-shelf” solar equipment does not satisfy the work requirement. Physical work with custom components does qualify, but given the level of standardization in the solar industry, this caveat often makes the physical work route less attractive.

Projects that are able to prove to the IRS that they were underway in a given year are able to claim the ITC percentage that was designated for that year. A Safe Harbor project must also be under a binding contract, ensuring that the original plan proceeds and that the tax credit supports actual energy development. For projects that are well underway in 2019, this option is reasonably easy to meet.

ROUTE 2 – 5% PROJECT COST

The second option for seeking Safe Harbor is simpler and regarded by many in the solar business as the better option. This is especially true for projects in an earlier stage of development. If a commercial or utility solar project incurs 5% of its total project costs before December 31, 2019, it is eligible to claim the full 30% ITC. Meeting this 5% threshold is a sufficient investment in the eyes of the IRS to tie the project to the 2019 tax credit level. The 5% cost can go towards materials or project components. Meeting this level of investment is often not difficult for solar projects since material costs are often much more than 5%, and proving material costs is more straightforward than costs for design, permitting, consulting, and so on.

The 5% minimum established by the IRS can be tricky since the projected total cost for a project is not always accurate. If the total project cost rises and the 2019 investment is suddenly less than 5% of the new total, the entire tax credit could be forfeited. Because of this, aiming for 7% of the total project cost is often recommended. That way, even if project costs fluctuate significantly, the 5% minimum is still covered.

Other considerations when seeking the 5% minimum include changes in technology in the intermittent years, and where and how to store project materials acquired in 2019, prior to their implementation on the solar project. Solar panels purchased in 2019 may not be the cutting edge tech by the time they are installed in 2020 or 2021. Wise project managers will choose best-in-class solar products like those offered by manufacturers like SunPower to ensure their effectiveness over the long term.

When it comes to storing the solar panels or other equipment purchased in 2019, being able to warehouse them until they are needed is a good option. Many solar contractors and some manufacturers will be able to store your materials in the meantime. Keep in mind that you will need to prove to the IRS that they were indeed purchased in 2019, even if they haven’t been delivered yet.

Overall, needing to spend only 5% of project costs to get the entire 2019 ITC is a pretty good deal, particularly if the tax benefits can be put to immediate use. Having materials on hand for projects that are in earlier stages of development can enable flexibility in the design and planning stages while still netting the ITC tax benefit. Just remember the clock is ticking on the full credit amount.

YOUR SOLAR ITC IS SAFE (BUT DON’T DELAY)

Another consideration for those seeking Safe Harbor for their ITC eligible solar project is that using the Modified Accelerated Cost Recovery System (MACRS) solar depreciation does not affect the ITC Safe Harbor status. MACRS solar depreciation is a way of accounting for the decrease in the value of an asset as it ages. The important thing to know is that using MACRS further increases the financial benefit of the ITC and that Safe Harbor is not compromised by using MACRS to account for the solar array’s depreciation in value over time.

Even though the investment tax credit for clean energy projects is under threat, by using the Safe Harbor offered by the IRS, there is still time to capitalize on solar power and its benefits. Safe Harbor can protect the generous federal tax credit on offer until the end of 2019, even if the project’s period of construction extends longer. By pursuing either the physical route or even better, the 5% cost route, Safe Harbor can be the difference between a profitable project and one that falls short.

The time to start a new solar project is now! As the ITC winds down, there will be increased demand for solar installers and experts as well as more for more specialized equipment or premium components. As project queues fill up, delays in permitting and other pre-build developments become more likely, so the sooner you act the more likely you are to maximize the effectiveness of your solar project.